Climate change

As a global investor with a long-term perspective, we recognise that climate change is a long-term systemic risk to markets and one of the most significant investment challenges we face. The response to climate change and necessity for a transition to a low-carbon economy also presents investment opportunities.

| Transcript | |||

|

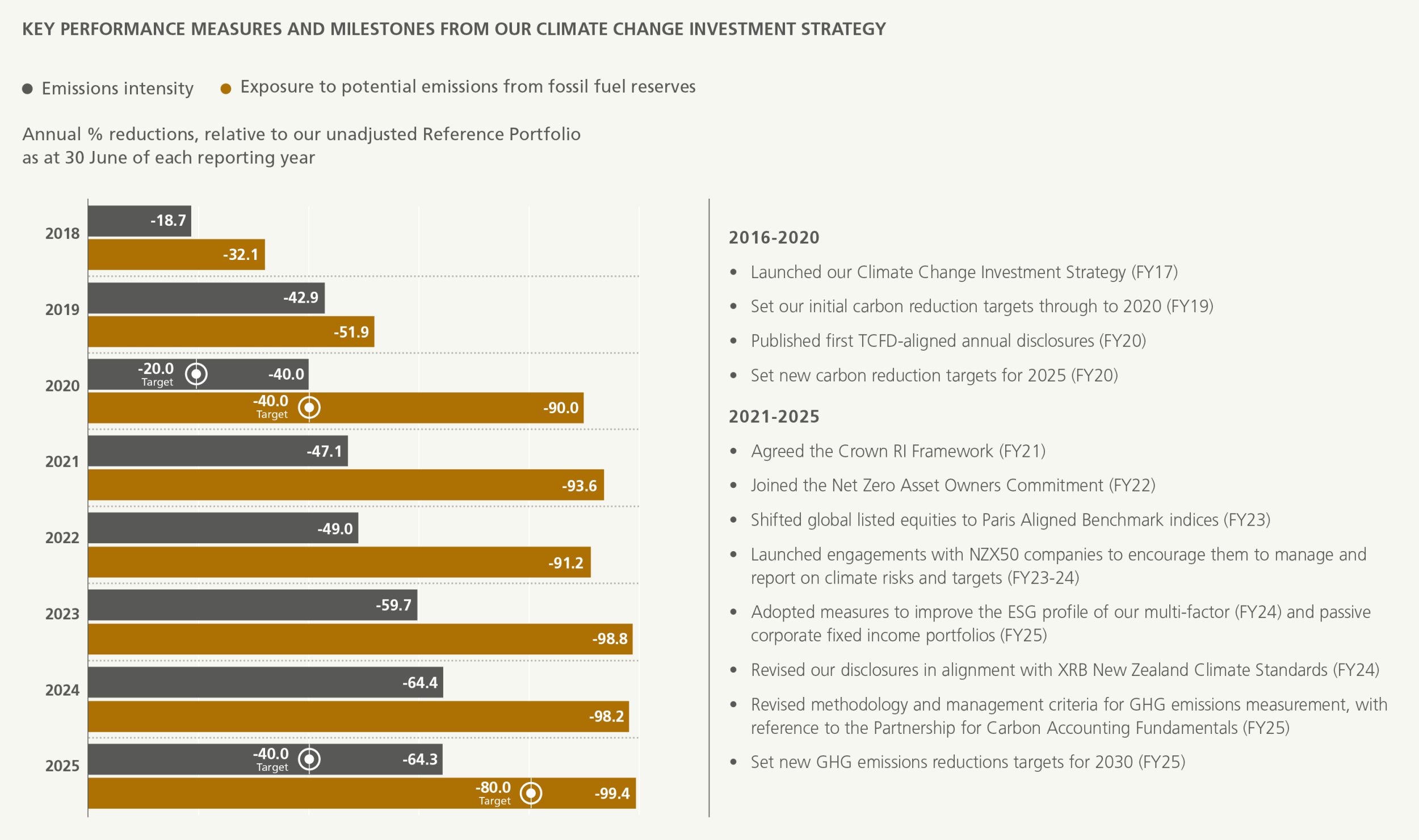

Our journey to decarbonise our portfolio began in 2016, when we launched our Climate Change Investment strategy.

Our aim was to reduce climate risk across the portfolio, including through emissions reductions at the portfolio level and by investee companies themselves.

Our early action on this issue reflects our belief that climate change is a long term-systemic risk to markets. It is one of the biggest challenges – and opportunities – facing investors.

Since introducing our strategy, we’ve significantly reduced our exposure to carbon emissions and our exposure to fossil fuel reserves – all while continuing to deliver strong returns.

We also shifted our Reference Portfolio to a Paris-aligned benchmark in 2022. This change not only reduces carbon intensity but also increases our exposure to climate solutions and companies actively transitioning to lower emissions, which is an important part of our Climate Change Investment strategy.

Setting clear targets has also been an important part of our carbon reduction approach. In 2020, we set our first five-yearly targets through to 2025 – and we exceeded them.

To align with our peers, we’ve now shifted to a new global methodology, PCAF, and a 2019 baseline for setting new targets through to 2030.

Our new targets are to:

and to

When setting these targets we considered a few different things.

We looked at what level of effort is needed to reduce long-term climate risk to the portfolio, keep us on the pathway to net zero and maintain strong financial performance.

We also looked at where we can have the greatest influence on real-world change through asset management, including in private markets.

And finally, we wanted to keep some flexibility – so we can invest in projects that help deliver climate solutions and support climate transition, even if they come with higher upfront emissions.

We recognise that our responsibility goes beyond managing risk. It’s about how our investments contribute to the transition that the world is going through.

We aren’t alone in this approach. Across the investment world, there’s been a clear shift in the way we think about climate change. It’s no longer only about how the risks affect our investments – it’s also about the influence our investments can have on the world for future generations. |

|||

Climate change presents material risks and opportunities for investors, including:

-

Technology: Advances in technology to support a low-carbon environment can create new investment opportunities and disrupt existing industries.

-

Resource availability: Slow onset shifts in the everyday environment can result in increased costs or reduced availability of land or natural resources, impacting industries and economies.

-

Impact of physical damage: Extreme weather events and rising sea levels can damage investment assets and infrastructure, and significantly impact insurability and financing.

-

Policy: Increased costs and complexity for business from changing policies and regulations designed to limit long-term effects of Climate Change and to encourage sustainable business operations.

-

Demand and supply: Changes in economic or social factors might affect demand or supply.

-

Litigation: The impacts that could arise if parties seek compensation for the cost or impact of climate change.

The effects of climate change vary across different sectors, regions, and types of investments. Some impacts are already evident, and we expect these to grow over time. By understanding and addressing these risks and opportunities, we aim to protect and enhance the value of our investments.

Strategy

Our Climate Change Investment Strategy, which is integrated into our wider sustainable investment approach, is built on four key pillars:

Climate targets

Every five-years the Board sets the Fund’s carbon emissions reduction targets and methods. We report against these in our annual Climate Change Report.

Our 2030 emissions reductions targets, measured against the Fund’s unadjusted Reference Portfolio, are to:

- reduce the carbon emissions intensity of the Fund by at least 75%

- reduce potential emissions from fossil fuel reserves owned by the Fund by at least 80%

To align with our peers, we’ve shifted to a global methodology, PCAF, and a 2019 baseline for our 2030 targets.

Progress against our carbon emissions reduction targets

In 2020, we set carbon targets for 2025. As of 30 June 2025, we had significantly exceeded our targets, with the Fund’s emissions intensity estimated as 64.3% lower than the target benchmark (the market-weighted, unadjusted Reference Portfolio at the end of each reporting year), and our exposure to potential emissions from reserves estimated as 99.4% lower.

To learn more about our carbon reduction targets and how we measure our progress, please see our latest Climate Change Report.

2025 Climate Change Report

Engagement in New Zealand

We collaborate with other government-owned investors to engage with New Zealand companies on climate change. Our joint position statement on climate change guides our direct engagement with large New Zealand companies, particularly those listed on the NZX50.

The collaboration includes the Accident Compensation Corporation, Government Superannuation Fund Authority, National Provident Fund Authority, and the NZ Super Fund. All four funds are committed to achieving net zero portfolios by 2050, reflecting best practices for leading institutional investors.

A mandatory climate-related disclosure regime is in place for around 170 financial market participants in New Zealand, including large, listed New Zealand companies and financial institutions. Our engagements with New Zealand companies aim to:

-

Understand their progress on climate change awareness, capability, and commitments.

-

Ensure they meet regulatory requirements on climate-related disclosures and reporting.

-

Support their transition by sharing knowledge of climate change risks and opportunities.

-

Understand how their plans align with our net zero commitments over time.

We report publicly on the number of engagements and overall progress in our Stewardship Report, while individual engagements remain confidential.

Global Engagement

Our global engagements on climate change are conducted through international collaborations with other investors and a specialist engagement service for global equities. This approach allows us to reach a wider audience and leverage the collective influence of large international investors.

Climate change is also a key focus for our engagement services provider, Columbia Threadneedle Investment. Their Responsible Engagement Overlay (reo®) service engages with hundreds of companies on our behalf. Climate change is a high priority area for engagement. Read the latest CTI Engagement Reports. CTI reo® continues to play an active role in CA100+.

We exercise our voting rights in listed equities globally and in New Zealand. Our voting guidelines support proposals for companies to manage climate risks and report on emissions.