Media statements

NZ Super Fund releases Climate Change Report

POSTED ON: 7 October 2020

Share:

|

- First report prepared in accordance with TCFD framework |

|

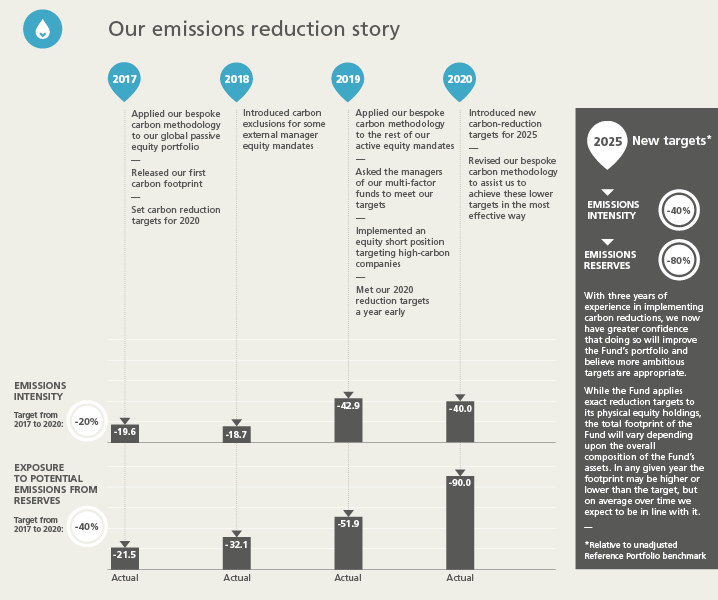

One of the core elements of the NZ Super Fund Climate Change Investment Strategy is to reduce the carbon intensity of the Fund’s investments and its exposure to fossil fuel reserves. In 2016, targets were set to reduce the Fund’s emissions intensity by 20 percent and its exposure to potential emissions from fossil fuel reserves by 40 percent by 2020. “Having met our 2020 targets we have set new, more ambitious targets and now aim by 2025 to reduce the emissions intensity of our portfolio by 40 percent and fossil fuel reserves by 80 percent," says Whineray. “I hope this recognition can help the New Zealand Superannuation Fund and our entire signatory base to keep raising the bar in responsible investment.”

|