Share:

Our Portfolio Completion team has boosted productivity and performance by automating overnight sovereign bond trades.

The new automation solution, built through Bloomberg, has been in the works since 2019. Following testing, rollout finished earlier this year.

Portfolio Completion invests in a range of government securities across Asia, Europe and America. As part of this approximately NZD5.5b mandate, they trade monthly, with a strategy to buy and sell bonds as near to market close as possible.

To reach markets in different time zones, they used to leave orders with brokers to execute trades manually overnight, which could become complex and time-consuming.

It was a challenge to trade at market close across time zones. Every month, they had to line up external brokers ahead of time and send them a spreadsheet with trades to execute overnight. The post-trade process of allocating and booking the trades was also manual.

Portfolio Completion sought out an automated solution to improve the efficiency and effectiveness of this process. When they approached Bloomberg, they found they were already building a solution that could help.

Bloomberg worked with the Portfolio Completion team to create a tool that would fit their specific needs, and the Guardians became the first in Asia-Pacific to use Bloomberg’s new tool for overnight trading.

The result enables Portfolio Completion to create a set of rules to govern automated trading. Instead of having to brief their brokers days in advance, they can now set up trades to fit their requirements.

“It opens up more opportunities to refine trading strategies,” explains Portfolio Manager Bob Xia. “Rather than trading everything at market close, we can spread that across the whole day as the system can do that on your behalf.”

The tool includes an order re-run feature. This means that if a trade isn’t executed because a parameter hasn’t been met, the system will try again, relaxing the parameters on subsequent attempts according to the rules set by the trader. This increases the likelihood of execution.

The tool also incorporates post-trade workflows. “The post-trade process is much more streamlined,” Bob says.

Portfolio Completion has improved trading performance, as rather than sending all trades to one dealer or a subset of dealers, individual dealers can be selected for each trade. This enables them to execute trades at the best available price. Portfolio Completion can also collect better data, giving more confidence in trades and improved insights.

The tool is now a part of the monthly trade cycle, and the team is reporting that more time has been freed up to focus on higher-value tasks. Now that the new process is bedded in, they’re looking to other possible applications such as equity mandates.

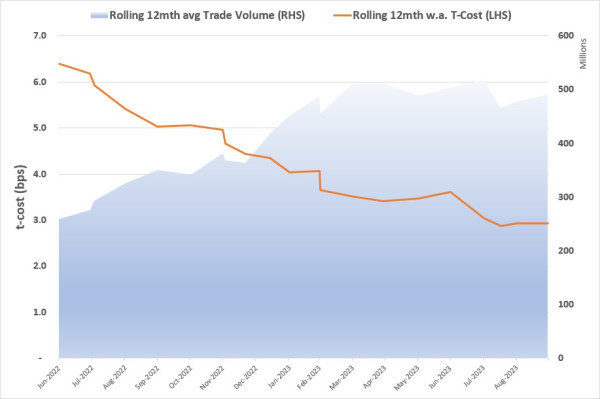

Rolling 12-month average trade cost and volume over the first year of using the automation solution